Irmaa Brackets For 2025 Income

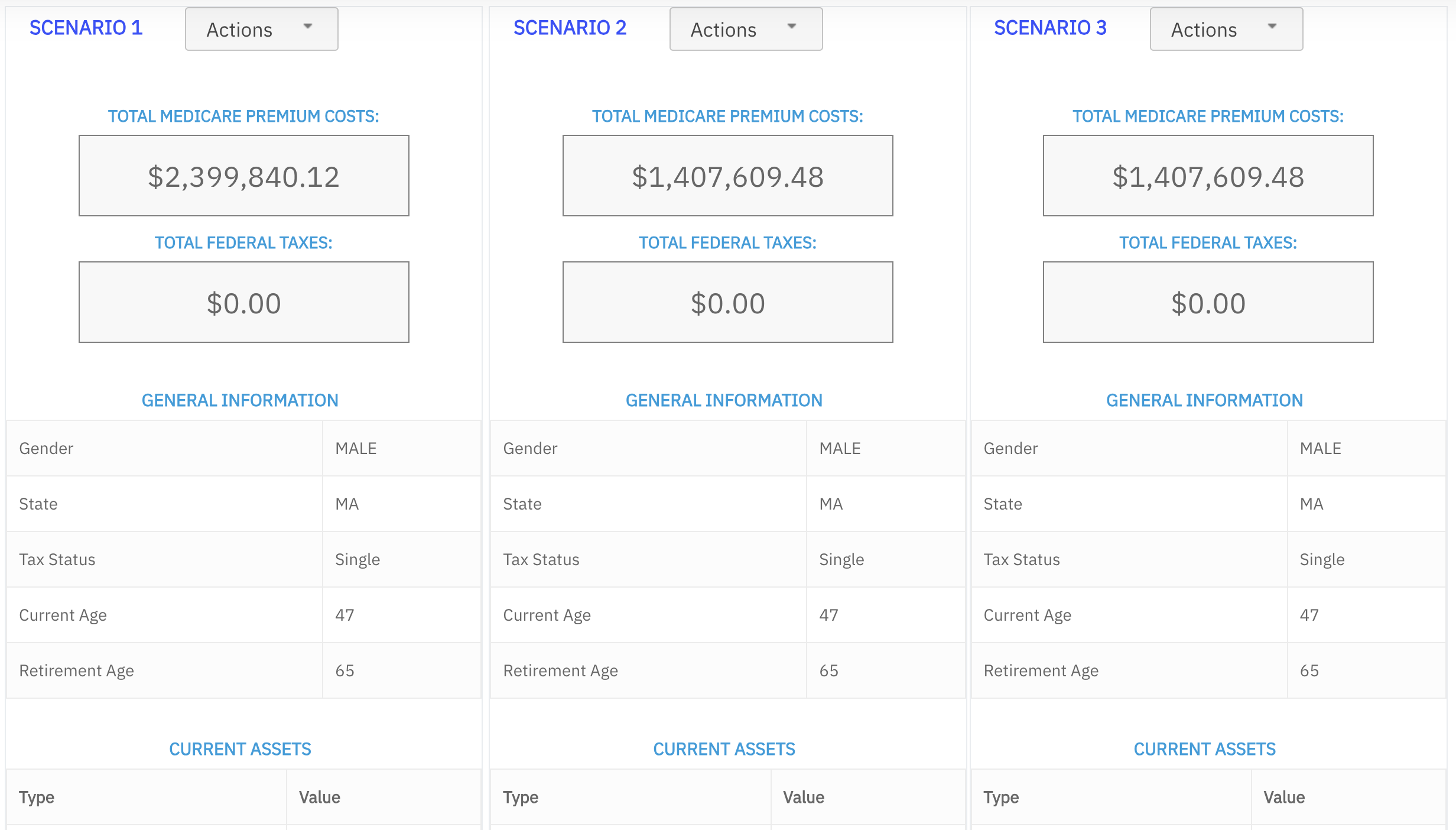

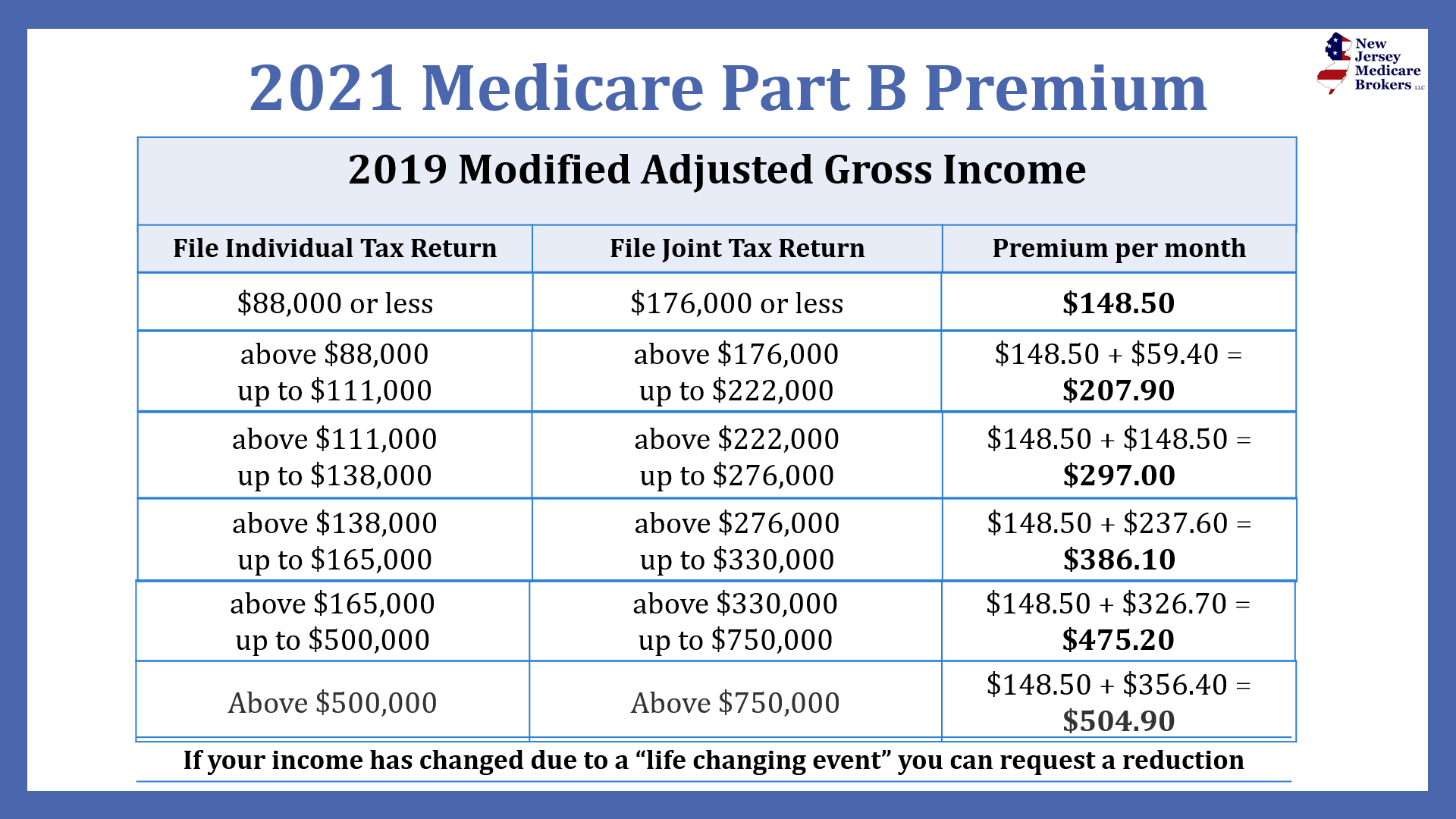

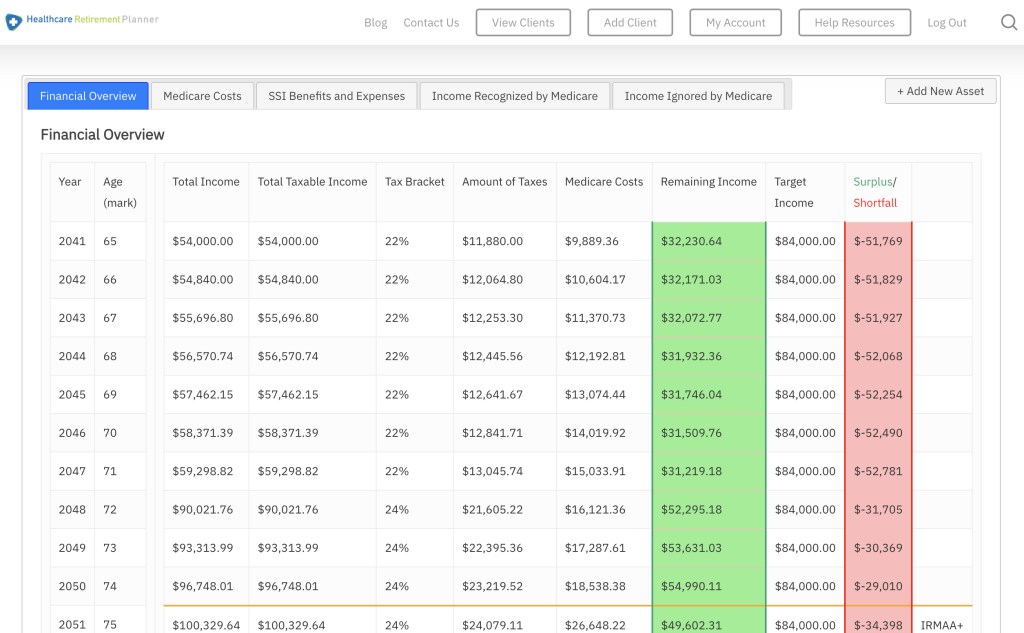

Irmaa Brackets For 2025 Income. Irmaa is short for medicare’s income related monthly adjustment amount which is according to the code of federal regulations: For 2025, the income brackets for part b and part d are the same.

Irmaa operates on a tiered system, with different. Here are the 2025 irmaa amounts for married taxpayers that file separately:

Irmaa 2025 Brackets Judy Clementia, To determine whether you are subject to irmaa charges, medicare uses the adjusted gross income you reported on.

Irmaa 2025 Brackets And Premiums Part D Premium Twila Martita, Read through this blog to be better prepared for.

2025 Irmaa Brackets Based On 2025 Danny Phaedra, Irmaa, or the income related monthly adjustment amount, is a surcharge to your monthly medicare premium that is based on your income from two years prior.

Navigating the Medicare 2025 IRMAA Brackets [UPDATED PREMIUMS, “an amount that you will pay for your medicare part b and d coverage when your modified.

Irmaa Tables 2025 Roch Rubetta, Here’s a chart explaining how income affects the part b premium and part d irmaa:

The IRMAA Brackets for 2025 Social Security Genius, The impact of the surcharge varies and is dependent on your income.

Irmaa Tables For 2025 Maura Nannie, To determine whether you are subject to irmaa charges, medicare uses the adjusted gross income you reported on.

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part b.

2025 Irmaa Brackets For Medicare Premiums Corie Donelle, In 2025, if your 2025 income exceeds $103,000 (for an individual return) or $206,000 (for a joint return), you will pay an extra amount on top of your plan’s part b and part.